The Future of Self-Executing Contracts in Digital Transactions

Understanding Self-Executing Contracts and Their Mechanism

Self-executing contracts, often referred to as smart contracts, are digital agreements that automatically enforce and execute terms when certain conditions are met. Imagine a vending machine: you insert money, select your item, and it automatically dispenses the product without any human intervention. Similarly, smart contracts facilitate transactions in a trustless environment, minimizing the need for intermediaries.

Smart contracts are a way to automate and enforce agreements without the need for intermediaries.

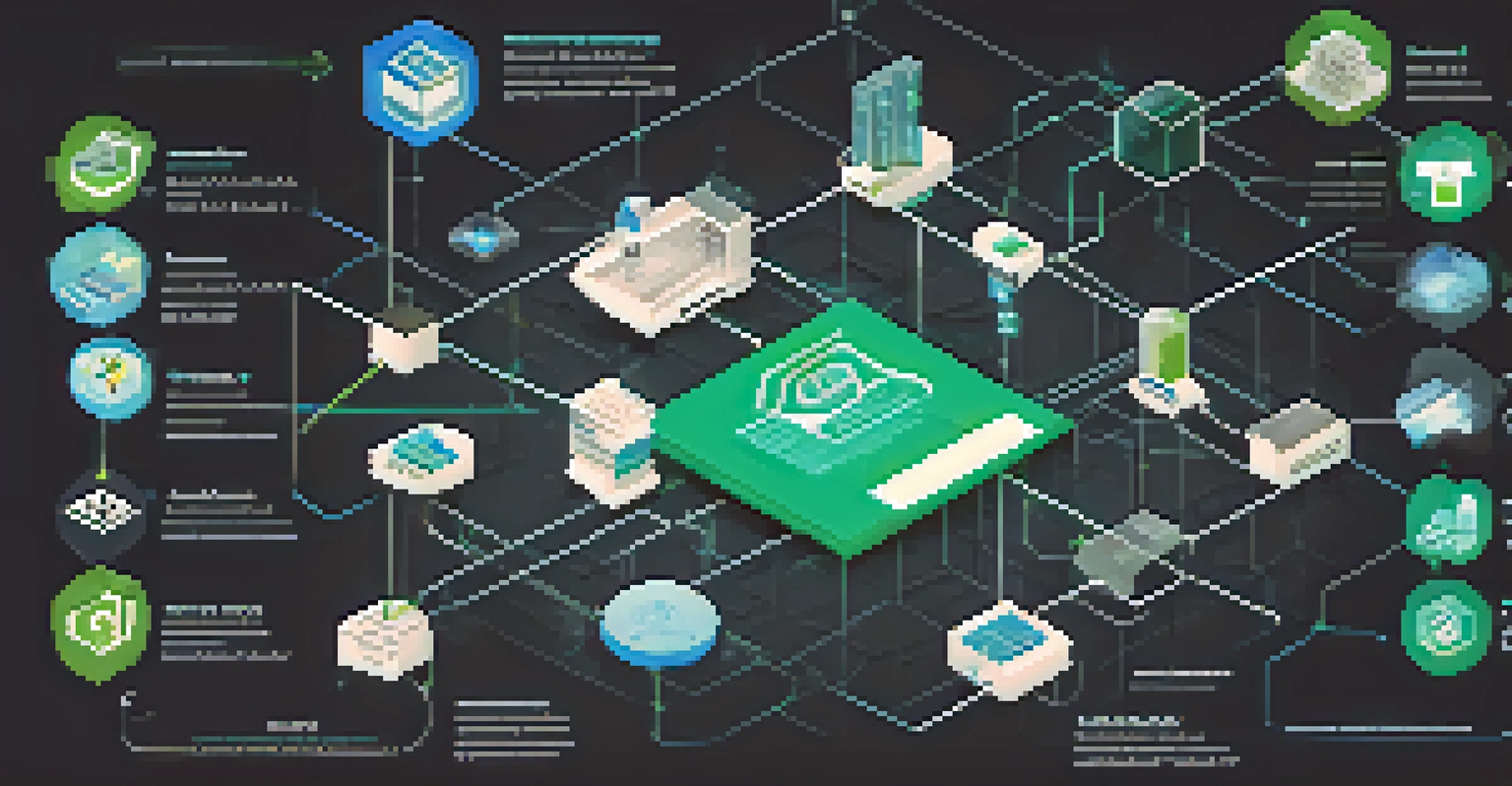

Built on blockchain technology, these contracts are secured and immutable, meaning once they are deployed, they cannot be altered. This creates a level of transparency and reliability that traditional contracts often lack. For example, a real estate transaction using a smart contract can streamline the process by automatically transferring ownership once payment is confirmed, removing the need for lengthy paperwork.

Related Resource

As the digital landscape evolves, so too does the potential for self-executing contracts. They are not just for financial transactions; industries ranging from supply chain management to healthcare are exploring how these contracts can enhance efficiency and reduce costs.

The Rise of Blockchain Technology in Contract Execution

Blockchain technology is the backbone of self-executing contracts, providing a decentralized ledger that ensures security and transparency. Imagine a public library where anyone can check out books, but no one can alter the records of who borrowed what. This is similar to how blockchain maintains the integrity of contract data.

With blockchain, every transaction is recorded in a way that is virtually tamper-proof. This means that once a smart contract is executed, all parties can trust that the terms were followed without needing to rely on a third party. For instance, in the world of insurance, smart contracts can automate claim processing based on predefined criteria, speeding up payouts for policyholders.

Smart Contracts Simplify Transactions

Self-executing contracts automate and enforce agreements, reducing the need for intermediaries and streamlining processes.

As more businesses recognize the value of blockchain, its adoption in self-executing contracts is expected to grow. This shift could lead to more secure transactions and a significant reduction in fraud, fundamentally changing how we approach agreements.

Legal Implications of Self-Executing Contracts

The rise of self-executing contracts brings with it a host of legal implications that must be considered. Currently, many jurisdictions are still navigating how to regulate these digital agreements. Think of it like the early days of the internet; laws had to catch up to the rapid technological advancements.

Blockchain technology enables us to trust the code, rather than relying on individuals or institutions.

One major concern is the enforceability of smart contracts in court. Unlike traditional contracts, which are often backed by legal precedents, self-executing contracts can challenge existing legal frameworks. For example, if a dispute arises over a smart contract's execution, determining liability can be complex, especially if the code is deemed ambiguous.

Related Resource

As the legal landscape evolves to accommodate this technology, it is essential for businesses to stay informed and possibly even seek legal counsel when implementing smart contracts. This proactive approach can help mitigate risks and ensure compliance with emerging regulations.

Challenges in Implementing Self-Executing Contracts

Despite their advantages, self-executing contracts face several challenges in implementation. One significant hurdle is the technical complexity involved in creating and deploying these contracts. Many businesses may lack the expertise to design effective smart contracts, which can lead to costly mistakes or vulnerabilities.

Moreover, the reliance on accurate data inputs, known as 'oracles,' is crucial for smart contracts to function correctly. If the data fed into the contract is incorrect, the entire execution can be compromised. Consider it like a recipe: if you mismeasure an ingredient, the final dish can turn out poorly.

Blockchain Ensures Security and Trust

The decentralized nature of blockchain technology secures smart contracts, making transactions tamper-proof and reliable.

Addressing these challenges requires collaboration between tech developers and business leaders. By working together, organizations can create robust smart contracts that minimize risks and maximize efficiency.

The Future Landscape of Digital Transactions

As we look to the future, the landscape of digital transactions is poised for transformation through self-executing contracts. With increasing trust in blockchain technology, more industries are expected to adopt smart contracts, leading to a shift away from traditional methods. This trend could revolutionize how we think about transactions, making them faster and more secure.

Imagine a world where buying a car or signing a lease could be done with a simple click, eliminating paperwork and reducing the risk of fraud. This future is not far off, as companies begin to integrate smart contracts into their operations. For instance, in the gig economy, smart contracts could ensure that freelancers are paid immediately upon project completion, streamlining the payment process.

Related Resource

However, the full realization of this potential will depend on overcoming existing challenges and ensuring that all stakeholders are educated about the benefits and risks. The journey is just beginning, and the excitement around these innovations is palpable.

Real-World Applications of Self-Executing Contracts

Self-executing contracts are already making waves in various sectors, demonstrating their versatility and potential. In supply chain management, for instance, smart contracts can automate processes such as order fulfillment and inventory management. This not only increases efficiency but also reduces the likelihood of human error.

Another notable application is in the financial sector, where decentralized finance (DeFi) platforms leverage smart contracts for lending, trading, and insurance. Imagine being able to lend money without the need for a bank – that’s the promise of DeFi. It allows individuals to engage in financial transactions directly, cutting out the middleman and often reducing costs.

Legal Challenges Need Attention

As self-executing contracts gain popularity, businesses must navigate complex legal implications to ensure compliance and enforceability.

As more organizations experiment with self-executing contracts, the range of applications is likely to expand. From real estate to entertainment, the possibilities are endless, and early adopters stand to gain a competitive edge in their respective markets.

Preparing for a Future with Self-Executing Contracts

To prepare for the future of self-executing contracts, businesses need to start by educating themselves about the technology and its implications. Workshops, webinars, and online courses can provide valuable insights into how smart contracts work and how they can be integrated into existing systems. Think of it as learning a new language; the more you understand, the easier it will be to communicate effectively.

Additionally, companies should consider partnering with tech firms that specialize in blockchain and smart contract development. This collaboration can ensure that businesses are not only compliant with regulations but also equipped with the best practices for implementation. For example, engaging with experts can help identify potential pitfalls early in the process.

Ultimately, embracing this technology can lead to significant advantages, including cost savings, improved efficiency, and enhanced security. As the digital transaction landscape shifts, those who invest in self-executing contracts today could be the leaders of tomorrow.